Track your Credit Score for ₹1200 FREE

Get detailed analysis of your credit score | Takes 1 minute

An OTP will be sent for verification

Powered by |

Trusted by 2Cr+ financially smart Indians

What is a Credit Score?

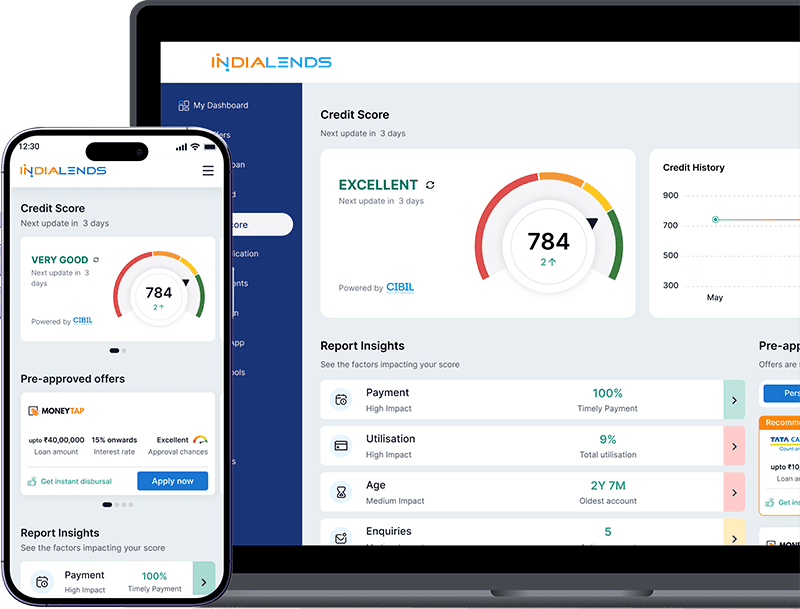

A credit score is a numerical representation of your credit profile. It ranges from 300 to 900, with higher scores indicating better credit health. Lenders use credit scores to assess the risk of lending to you.

Powered By

CIBIL Part Of TransUnion

800- 900 Excellent

This is the highest score bracket. You can expect most lenders to offer desired loan amount as well as high credit limits at the lowest prevailing interest rates. Keep up the good work to maintain your score.

750- 799 Very Good

You have shown responsible borrower behaviour in past. You can expect desired loan amounts as well as medium to high credit limits. It’s important to keep up the good work to ensure your profile is remains strong.

700- 749 Good

Your profile may be viewed favourable by some lenders. However, you should expect desired loan amounts at higher interest rates and lower credit limits. Take immediate steps to improve your score further.

650- 699 Fair

This indicates that you have not followed the credit terms offered to you in the past. You can expect limited loan options with high interest rates. You should consider immediate steps to improve your score.

300- 649 Poor

You would likely find very few credit providers offering a credit product to you. You can expect lower amounts at higher interest rates. It is advised to opt for Credit Score improvement initiatives to improve your Credit Profile.

Why is it Important?

Loan approvals

A good credit score represents good borrower behaviour & a strong credit profile. Thereby, increasing your chances of loan approval.Better interest rates

Lenders view those with a good credit score as low risk borrowers. Therefore, a higher score helps you in getting lower/favourable interest rates.Job opportunities

There is an increasing trend with Top tier companies to include credit score check as part of background verification. Higher scores represent responsible financial behaviour and improves chances of acceptance for employment.Rental applications

Some landlords may require you to share your credit score at the time of renting a home. Since a landlord rents out their property against a promise to pay regular rent, a high credit score becomes a good representation of responsible payment behaviour.Credit card applications

Good credit score opens doors for most of the credit cards in the market. You can easily get high end cards with higher limits.Components of a Credit Score

How can you improve your credit score?

Make timely payments

Making timely payments shows lenders that you are responsible with credit and adhere to your payment obligations as agreed in your credit agreements.

Maintain your credit utilisation:

Lesser credit utilisation means you use credit wisely and only when necessary. Your ideal credit utilisation should be less than 30%.

Make timely payments

Making timely payments shows lenders that you are responsible with credit and adhere to your payment obligations as agreed in your credit agreements.

Don’t apply too frequently

If you’re applying too frequently, lenders might think you’re in dire need of credit and that is your primary source for money.

Have a credit mix

Lenders prefer credit profiles with a balanced mix of secured and unsecured loans.

Frequently Asked Questions

-

A personal loan is multipurpose in nature which means that you can use the amount for any purpose. Unlike home loans or car loans, where the lender restricts the use of the amount for specific purpose, personal loans can be used for any need.

-

Apart from being multipurpose in nature, personal loans are usually security free, disbursed instantly or within a few days and can be applied for with minimal documentation. You can check pre-qualified personal loan offers for you and apply online on the IndiaLends website.

-

While the minimum eligibility criteria to apply for a personal loan in India varies from lender to lender, certain parameters are common. In general, you must be 18-65 years old, have a minimum credit score of 720 or more and a monthly income of ₹20,000 or more.

-

Contrary to popular belief, just like any salaried individual, a personal loan can be availed by self-employed individuals as well. Anyone self-employed individual who meets the minimum eligibility criteria and has ITR for the last three years of their business can get a personal loan from IndiaLends.

-

Ideally, one must have a minimum credit score of 720 to 750 to get an unsecured personal loan at reasonable rates. Since your credit score determines your creditworthiness, banks & NBFCs consider this as the predominant eligibility criteria for a personal loan.